REAL ESTATE CONSTRUCTION PROJECT. THE EVERGRANDE CASE.

Introduction. II. Evergrande, first steps. III. A business model widely used in the world. IV. Evergrande and its path to crisis. V. Lessons learned.

Introduction.

One of the primary needs of the human being is housing, so the real estate business turns out to be very attractive because it meets that primary need. Construction companies are traditionally the ones that lead this type of business and the case of the Chinese company Evergrande is no exception. Its business model is based on buying land, designing a real estate complex and starting to sell it before construction begins. The investment in the construction is made through debt plus the resources obtained from the pre-sale of the properties to the final buyers.

II. Evergrande, first steps.

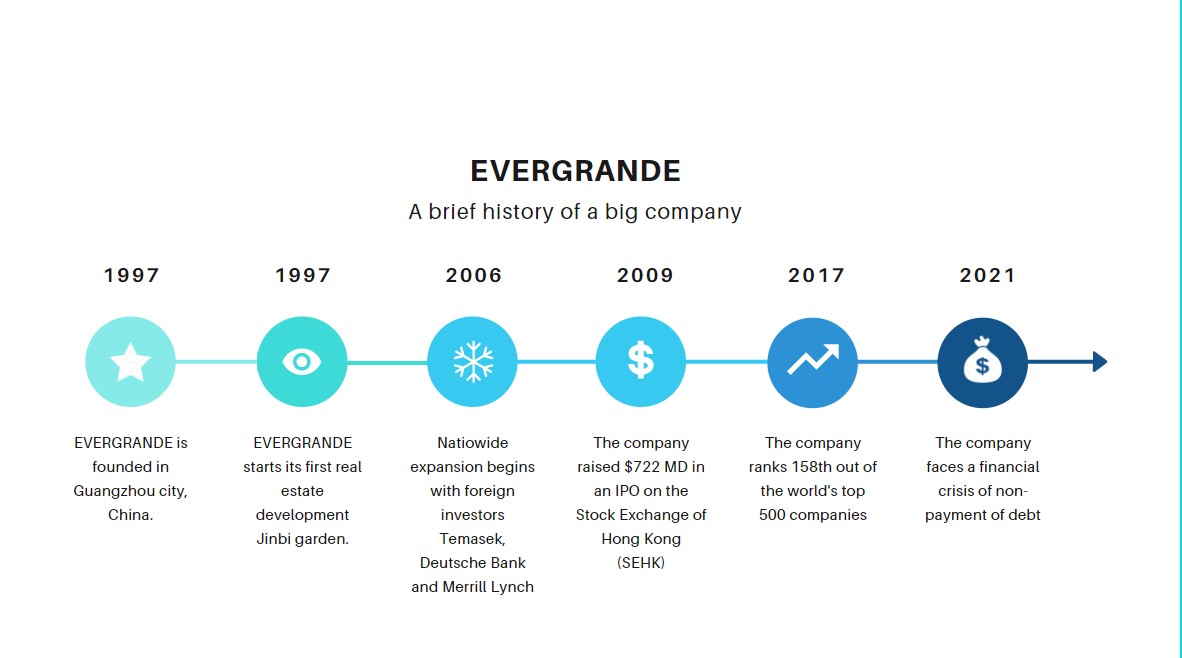

Evergrande Real Estate Group was born in 1996 in the city of Guangzhou, China [1] , its founder is Xu Jiayin [2] . The company's first big business was generated in 1997 when they bought land belonging to an old pesticide factory and built the “Jinbi Garden” residential complex on it, immediately selling 323 apartments. [3] Why were you so successful in selling the apartments? According to the Mexican newspaper “El Financiero”, in 1998 “…China created a real estate market throughout the country after strictly restricting private sales for decades, only a third of its population lived in towns and cities. Now almost two-thirds do so, which increases the urban population by 480 million…”[4] .

With data obtained from the EVERGRANDE website.

III. A business model widely used in the world.

The real estate business model has, among other things, the following components:

Market study

Business plan

Acquisition or contribution of land

Investment in Design or executive project

Financing

Pre-construction.

Presale

Building

Completion and delivery

Next, we will highlight some aspects of each of these components, the land is the fundamental element of the business, obtaining it is the result of the sharpest and finest vision of the business leader, since it must be obtained at low cost and in the best locations. , the development plans of the populations must be analyzed to explore the possible sites in search of information, before acquiring the land a deep analysis of the legal situation of the property is needed to avoid problems with the property, many times the land is be the success or failure of the project itself. The market study is needed to determine, among other things, the feasibility of the project location, the supply and demand in the selected location, the social and economic aspects of its population plus all the necessary information about the chosen area, all in order to determine the most profitable purpose and type of construction. Many companies use an EPE - special purpose company - as a project company. Once the company has the chosen property, legally insured and determined the most profitable type of construction, it proceeds with the initial investment in the executive project or design which will give us the cost of construction of the property, with the executive project will be processed the necessary permits and licenses for the construction of the property and from this all the economic data for the business model will be extracted, which must include taxes, procedures and all the expenses incurred,

Own capital + credit

Own capital + credit

Own capital + presale + credit

Presale + credit

Capital raising in the financial market (IPO)

Crowdfunding fintech platforms [5]

In the planning phase and taking into account the complexity of the development, it will be determined whether the construction will be done by the development company itself or if it will hire local construction companies to minimize costs and transfer the construction risk to third parties, many times several companies are hired. companies to mitigate risk. In any case, if this method is used, having specialized advice on the construction contract, its annexes and the contractual control and monitoring processes and due diligence in the selection of contractor companies will be crucial to mitigate the risk of non-compliance. in this phase of construction. Constructions must have strict quality control to avoid future claims,[6] [7]

IV. Evergrande and its path to crisis.

Understanding the above, we will see the reasons that led a large company like Evergrande to be in a situation of non-payment of debt that puts not only the company in serious trouble, but also its creditors and other players.

Some key facts about this Asian construction giant [8] :

It owns more than 1,300 real estate developments in China.

Evergrande is $300 billion in debt.

Around 12 million homeowners live in properties built by Evergrande.

Evergrande manages enough land to cover the entire Manhattan area.

Evergrande is indirectly responsible for 3.8 million jobs

Evergrande's debt equals 2% of China's GDP

Since 2012, a Citron Research report allegedly attributed to Andrew Left [9] indicates that since then the company has been insolvent, that its business model is unsustainable (pre-sale + credit), low prices, a deteriorated financial condition and assets substantially exaggerated, in August 2017 Evergrande commits to reduce its debt, in 2018 the Chinese central bank targets it as a possible cause of risk to the financial system, between 2020 and 2021 several events take place that put the crisis on the horizon .

New debt reduction plan.

Due to the coronavirus, the sales of their properties fall drastically

The company offers discounts of up to 30% on the sale of properties

Between November 2020 and January 2021 Evergrande raises $5.2 billion in two initial public offerings

Partial asset sales

Legal problems with the China Guangfa Bank

Hong Kong banks refuse to grant new loans to their clients

China changes the real estate regulation forcing developers to sell only fully completed constructions, that is, pre-sale is eliminated, this is a fundamental change in the country's policy, we recommend the excellent interview with Alicia García-Herrero, chief economist at Natixis in Hong Kong [10] .

Suspension of construction works

The company faces lack of liquidity and risk of default due to the suspension, requests extensions for debt payment.

Evergrande fails to pay $83.5 million in interest to its creditors. [eleven]

V. Lessons learned.

Each company, depending on its size and financial condition, will observe the problems mentioned, from a different perspective, however, all of them at some point have gone through or will go through one of them, balance is the word that should guide us in the real estate business, the risk of anchoring the business in debt must be manageable, otherwise the debt will "eat" the profits, balance generated by achieving the total construction of the property without depending on the result of the pre-sale ensures that customers will receive what they buy within the agreed term, exhaustive planning is the key to quality works that are built within the planned terms and amounts, all unforeseen events and deviations impact the time and cost of the work and consequently will directly affect profits.

The growth plan of small and medium-sized companies will have to be reviewed in the light of the experiences of giant companies. It is necessary to review the changes in housing and development policies of each country where it is built, to reorient the plans of business and company growth, an exhaustive and supervised debt plan for growth, internal anti-corruption policy, specialized engineering and legal teams for the planning of its works will be crucial to maintain growth. On the other hand, large companies will have to audit their processes and review their finances, to avoid serious problems like the ones Evergrande is currently facing.

CBJ SC

https://www.despacomata.com

[1] Obtained from the Evergrande website. https://mobilesite.evergrande.com/en/about.aspx?tags=5

[2] Obtained from the BBC website. https://www.bbc.com/world/news-58659647

[3] Obtained from the website https://lemexico.mx/2021/09/24/mundo/china-xu-jiayin/

[4] Bloomberg Businessweek supplement published on September 23, 2021 obtained from the internet at the following electronic address: https://www.elfinanciero.com.mx/bloomberg-businessweek/2021/09/23/evergrande-y-la- stress-test-that-no-one-wanted/

[5] https://www.briq.mx/projects https://expansive.mx https://www.m2crowd.com

[6] Obtained from the website of the magazine Obras de Grupo Expansion https://obras.expansion.mx/construccion/2018/08/29/urbi-pagara-634-mdp-a-consumidores-por-reclamos-ante- the-prophecy

[7] http://acolectivas.profeco.gob.mx

[8] Data obtained from the INSIDER website. https://www.businessinsider.com/what-is-evergrande-china-real-estate-giant-scale-perspective-2021-9?r=MX&IR=T#3-around-12-million-homeowners-live- in-properties-built-by-evergrande-4

[9] Obtained from the following electronic address https://cdn.gmtresearch.com/public-ckfinder/Short-sellers/Citron%20Research/Evergrande%20Citron%20presentation.pdf

[10] Obtained from the following electronic address. https://www.rfi.fr/en/economy/20210924-china-evergrande-alicia-garcia-guerrero-natixis-asia-real-estate-world-economy

[11] Data obtained from https://www.reuters.com/business/china-evergrandes-snowballing-debt-crisis-2021-09-14/